This Ticker is the New Game

Bid and Tonic 5, Onsen Edition

Greetings from the land of Sapporo Classic! (Macrobrew, Japan!) After the bonkers sprint I had from August to November, I decided to take some time off and take a small break. Call it the block leave I never stayed long enough in a bank to receive. While Buffett models his “healthy lifestyle” syndrome after 6 year olds (in another aw shucks golly gee type anecdote), I prefer a regimen of cold beer and hot onsens. (One of my favorites is here, if you ever find yourself in Hokkaido — the outdoor hot springs in Jemez, NM during snowfall are better, but the Japanese one wins out due to the killer Indian restaurant attached.)

While the bankers and the traders have finished the tax optimization for the year and the accountants are stuck with the…. accounting… markets tend to ping pong around and not much really happens (other than the MSTR mess, which I’ll cover another time). It’s another month until the next admin truly shifts into gear, so let’s take a look at what exactly has gone on.

I often say that the most actionable post I’ve written was This Ticker is the Endgame (3/26/24):

But when dollars are untethered from productivity, we get a different form of thinking, where Paris Hilton is more of a pioneer than Benjamin Graham. No longer is future cash flows the driver of valuation, but rather how much attention paid convert to bid? When we look at it from this purview, we arrive at my concept of “tradable hype” which explains a lot of the crypto/resale market:

A speculative purchase of a pair of limited edition Nike shoes could reasonably be thought of as a bet on the employees’ efforts to increase the brand’s reputation and appeal and be electronically traded in a similar manner to a token…

Although tokens might trade in a quasi-equity style, they aren’t equity — they have no place in the cap stack and don’t actually represent any ownership in the company. They operate almost as a tradable representation of “hype”, like a wine from a vineyard that is growing in reputation might appreciate.

Indeed, as the of end of year posts will show, this framing allowed for a ludicrously accurate reading of how 2024 would play out, from stocks to elections to memecoins to Jeremy Fragrance and more. They all follow the same attention pattern:

To be clear, I don’t think this is really a good thing. I often write about the problems with over-securitization

In the smartphone-driven instantaneous information access age, there's virtually no ability to remove the prior of access. One imagines Dostoevsky's Gambler would be much less interesting to read about if he existed in a nation that had no roulette. Beyond the sports betting ads shoved ad nauseam in every broadcast, nook, and cranny of ordinary society, it's never been more impossible to *avoid* it all. The securitization of everything was not made to withstand seamless speculation. The endless operation of markets, and markets on those markets, and markets on *those* markets, means that no matter where you are in the world, as long as there is internet access available, you can place a trade, having done so myself 35,000 feet above the Pacific Ocean on my way to Singapore. This seamlessness has corrupted the speculative flywheel. At least the speculation on securitization used to be tethered to reality in some technical sense — crude oil prices do fluctuate on supply and demand, and there is a functional utility to enable hedgers and the insulation of risk by allowing the trading game to proliferate. And, of course, speculation by investing was always tethered to creation of future value — by definition, this cannot result in a zero-sum state as long as the world functions on the growth assumption.

where the hardest part about placing trades for me is not risk management, or sizing, but just finding a way to suspend the disbelief as to how goddamn stupid everything has gotten.

Prior to election night (I guess, on election day Singapore time), I mentioned how I truly believed things had to change:

I have been pretty certain for a while now that an administration shift needs to happen simply so that some organic change can occur. I don’t expect the “economy” or “GDP” or “inflation” numbers to reflect why I think this is good — in fact, I very much expect numbers to go down (index, single stocks, etc.) organically in a way probably nobody under the age of 50 has actually experienced. But I truly believe that the greatest human innovation of my lifetime — instant information transmission anywhere in the world — allows mass coordination and focus of talent irrespective of location on novel problems, and we have never actually tried to take full advantage of this as a society. As soon as we stop building things solely on the internet and instead lever off the internet to build in conjunction with reality, I think all the hand-wringing about debt, de-dollarization, attention spans, social contagion, and so much more will look really silly from the rearview mirror a few years from now. The thing about news is, there’s no bite-size amount of information that can accurately describe anything. By and large, you choose whether you hear good news, and you’re fed the bad news under the guise of “staying informed”. Change is just change, nobody knows whether it’s good or bad in real time — if you choose to try and fix things, or at least believe they can be fixed, things have a way of working out.

The underlying implication of why I’d travel for two months out of the country and why people don’t like change and look for normalcy is that you simply don’t know what to expect, as when volatility is not artificially suppressed in reality, just as in markets, truly variable outcomes occur.

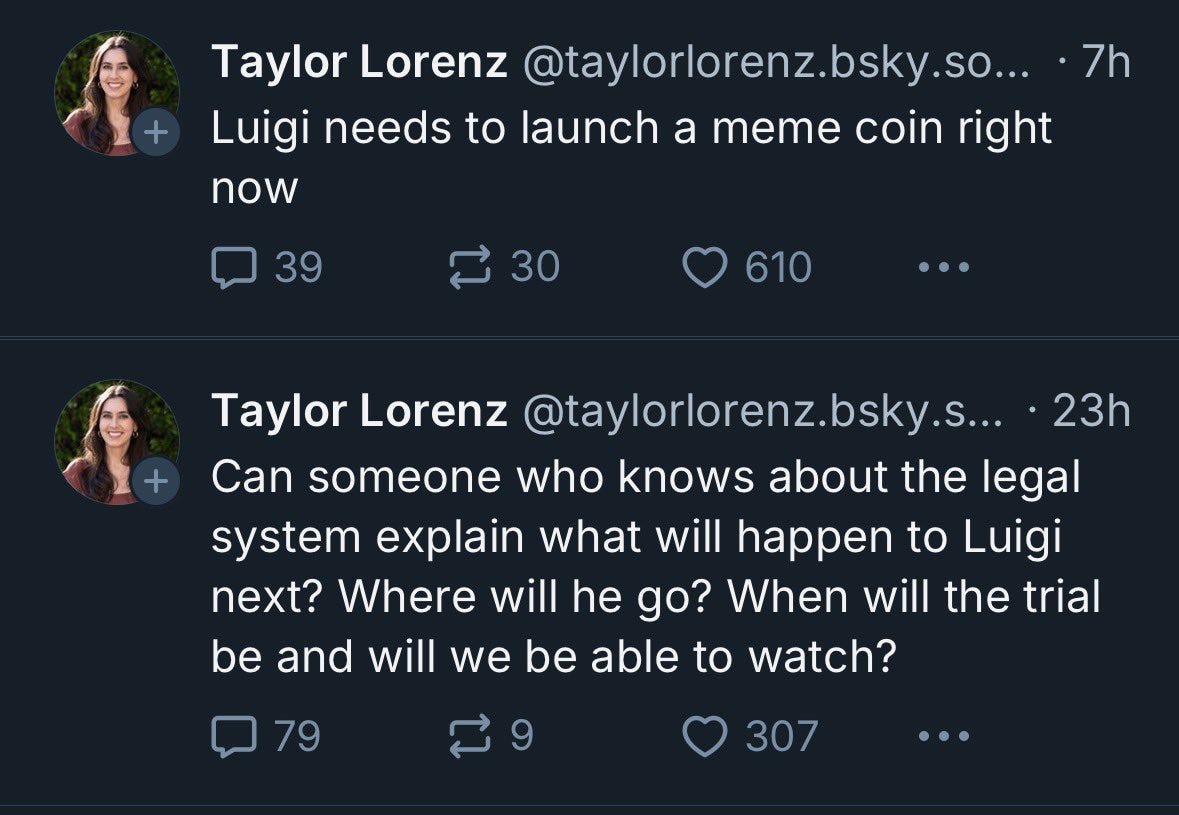

God knows I am not one to mince words, avoid memes, or not make the “too soon” joke. But the fact of the matter is, at least the implication of “too soon” needs to be there if you’re going to make an otherwise-depraved comment. In the post-election dearth of actual content, something was bound to break through the dazed haze of holiday gluttony, but it is outright jarring how this has become a part of “discourse” from no less than Elizabeth Warren, AOC, and The Atlantic. This isn’t supposed to spark a “discussion about healthcare”, it’s a lunatic who probably oneshotted his brain Landshark-style who had a mid reading list, a mid github, and a pretty awful review of the Ted K manifesto, which I have certainly alluded to knowing quite well given the last Malt Liquidity post was titled Postmodern Society and its Future. About the only interesting part of this story to me is why he ended up at that McDonald's that wasn’t particularly far from Manhattan, and why everything incriminating was just on him.

I have long thought that the decision to take Twitter private was the most important decision made in post-ZIRP America. As someone who knows how to spot and manipulate algorithms to my liking in real time (ask me sometime about the DRUG trade I made), an uncensored X feed is like a turbocharged Bloomberg newswire. It follows from my take that true internet networking has never actually been tried yet. But, this obviously comes with some side effects, in that we don’t really know how to operate in this reality, and that’s where the whole Luigi phenomenon comes into play. I saw it from the moment I stepped into undergrad — things were very different from the “become a lefty in college, then start paying taxes and learn how the world works” pipeline most of my bar friends experienced. Namely, it’s because kids had access to the internet and formed views prior to college:

Notably, those internet environments had the tendency to become extremely toxic due to the dissonance of the screen. And thus the “going through the motions” of say, introducing yourself with pronouns, or clicking through the module, or sitting through a diversity training seminar, became the way people actually framed their thinking, and the centralized social media apparatus was demarcated accordingly. You catch yourself when you realize how much it wired itself in your brain — even I’m prone to it. For example, I was sitting in a small Indian restaurant in Otaru the other day where some Aussies were dining, and they went to pay their check at the counter. The Indian lady running the shop tells them their total, they pay, and then ask “how do you say thank you in your language?” She replies (as she lives in Japan, of course), “Arigatou gozaimasu”. The Aussies reply “no, I mean your language, like where you’re from.” If I got caught saying that line in my undergrad, I’d have been court martialed. (They proceeded to ask if there was a place to buy hashish, at which point I had to turn away to control my internal laughter.)

Twitter —> X got the ball rolling, Trump’s (first) failed assassination accelerated it, and his election victory completely destroyed the normal framing of discourse that many of us online-types have gotten accustomed to in the post-2016 world. And with this comes the fact that people are re-orienting themselves as to what’s okay and not okay to post. This is, overall, a good thing in my opinion. I don’t think you should get fired for having an edgy take if it contradicts the orthodoxy. That being said, it is completely unhinged that something that should be blatantly obvious — icing CEOs GTA style is not a rational thing to do in any semblance of the word, and should obviously not be cheered on or framed as a discussion point — has seemingly taken hold as a rallying point in a chunk of the mainstream. How large this chunk is, I’m not sure, but there is the fact that LUIGI is somewhat liquid and commands a market cap in the 8 figures. I haven’t seen this in my lifetime in the US — this is something I’d expect to see in, like, post-Soviet or pre-invasion Russia:

When millionaires are in fight or flight, it results in political instability. A signal of Eastern bloc instability is when ultra wealthy people start randomly dying — a particularly noteworthy one to me was the “sausage billionaire” being executed in his sauna by a crossbow. I started to expect something major to happen after, and of course, Russia invaded Ukraine. Rich people war over their respective pots when there’s no wealth creation — the domestic instability resulted in another pot being sought out. (Oddly enough, 2 years later, another Russian sausage billionaire died after falling out of a window in India, the Moscow special. I guess they knew too much about how it was being made.)

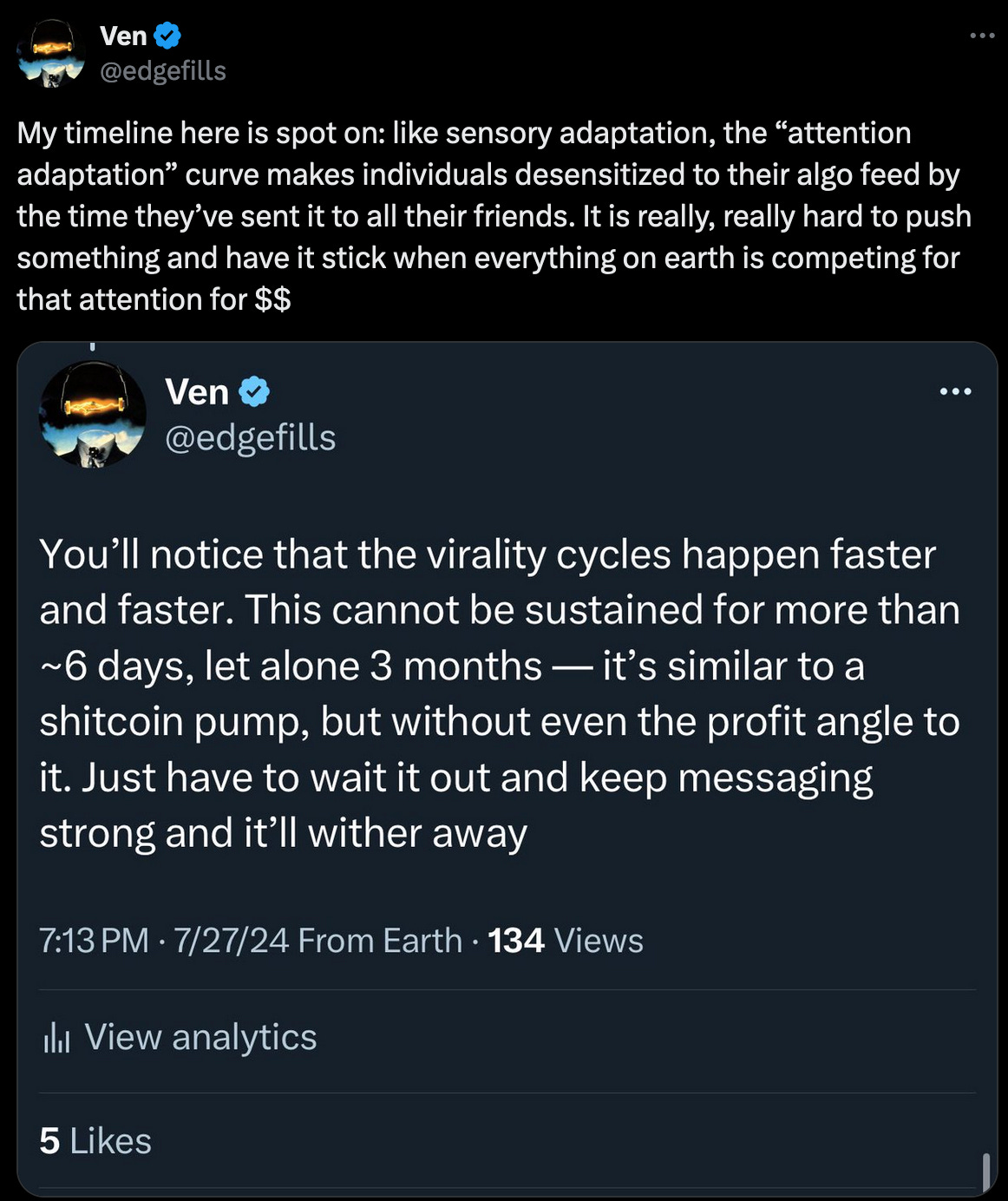

The attention bug is a particularly dangerous one, because it realizes as a tail phenomenon rather than something “on-distribution”. I am loathe to refer to Malcolm Gladwell, but his longform on John Ladue hits the nail on the head. Once the initial action is realized — in this case, Columbine — the template is there to move forward and replicate, which is a much lower threshold than taking a novel course. And as more and more people replicate it, the easier it becomes to justify an action. This is the exact same way memecoins replicate through clones, or QE coerced the market into pricing in a turbocharged Fed put every time anything even remotely flashes “recession”. (Seriously, why are we looking to cut rates here?) A vast majority of people will have normal, if sometimes unseemly, reactions, but eventually tune out on the time horizon, but it only takes one person on the far tail of obsession to kickstart the attention cycle once more. Not that this is novel, but the speed and profit attachment are definitely new. Consider the fact that Luigi’s X follower count went from a few hundred to hundreds of thousands in a matter of days, and people tried to buy his jacket en masse. The corollary of Kaczynski, on the other hand, required a ~20 year bombing spree for his manifesto to get published in the Washington Post. Is this really sustainable, or something that can be hockey-sticked out of?

The core problem I’ve always seen with crypto/web3 is that the culture is too oriented towards number-go-up (remember pump.fun in November?) and due to the fact that the potential gains realized are generational, and there’s literally no barrier to launching a scam (see: $HAWK for the most recent example), a really solid technology that has many uses adjacent to number-go-up is fairly likely to result in Bitcoin or bust, destroying all the goodwill built up against Gensler and SEC overreach, because stupid stuff just won’t stop happening. Who is going to stick their neck out for, say, a proper fan rewards ecosystem for the NBA to prevent gambling-driving-viewership from bageling the league when it requires similar functionality to any number of scams that have pumped and rugged in the past few months?

I often feel that, when I travel to other, less-financially oriented parts of the world (because financialization is absolutely as American as it gets), I’m on the moon. I wandered into a cafe the other day and ended up having a classic google-translated conversation with a drunken man who wandered over to my table. When he asked me what I did for work, I said, “I trade stocks.” He proceeds to ask me, “what’s a stock?” (Ironically enough, the first time I was in Tokyo, I gave the same answer to a drunk businessman, who replied “Oh! BITCOIN!”) What a reality, huh? I completely forgot that Japan traders think in FX instead of FTX.

I really don’t care whether people are going to have bad opinions, unsavory opinions, or be bad people. That’s for someone else to sort out, as much as I think about that True Detective quote:

We became too self aware; nature created an aspect of nature separate from itself. We are creatures that should not exist by natural law. We are things that labor under the illusion of having a self, a secretion of sensory experience and feeling, programmed with total assurance that we are each somebody, when in fact everybody’s nobody.

But this shouldn’t be profitable or even tradable. Like, why on earth is this where a certain infamous personality’s mind goes?

A majority of people, of course, when presented with all of this nonsense would simply suggest to “stop saying odd shit”.

But, people are not going to unplug from the attention infrastructure, the content pipeline, the reels and TikToks on demand, whatever. They’re going to see what’s next. The meta may change, but the underlying patterns stay the same. As a long-lost post on my timeline scroll said, a world where BTC is $1,000,000 is much scarier than a world where BTC is $0. As to which is more likely, who’s to say?

If you’d like to tune out and step in a piping hot pool, followed by a meal of fresh fish and cold beer, feel free to forward this email to hopefully find some company

EMP/GMD, whichever comes first. The sooner the better. Hope you aren't flying. ;)