Regime is Collapsing

Bid and Tonic 4

The first “real” movie I ever watched in theaters, as opposed to viewing Pirate Bay downloads when I was supposed to be asleep, was Inception. To this day, it’s still my favorite Nolan movie, although my teenage crush on Ellen Page, er, didn’t age quite as well. And, personally, I’d prefer corporate espionage dream-hacking to enforce antitrust policy to Lina Khan and the DOJ, who recently took the liberty to kill Spirit Airlines for no reason in between their various political prosecutions.

I bring up Inception because market regimes, in a way, are kind of the same thing as the constructed dreams that distort the mark from reality in the movie. A “dream architect” could realistically be thought of as the set of administration policies, macro environment, and collective sentiment that dictates the manner in which the market ebbs and flows. And, the sooner you realize that you’re in a dream, the less likely you are to get caught out when it collapses.

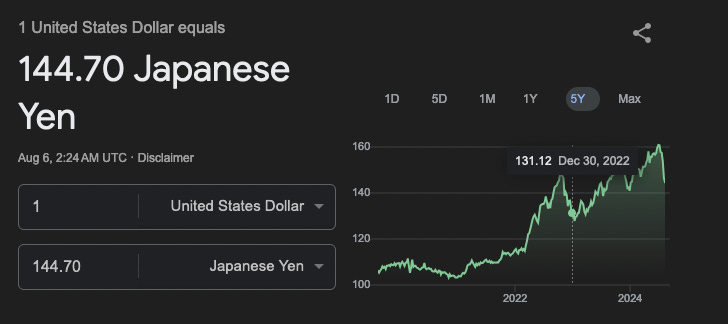

Regime shifts are not always telegraphed or obvious — indeed, a fair chunk of automated portfolio management is quantitatively defining and identifying regime shifts as quickly as possible. However, I tend to shy away from this approach, as a large part of what ends up defining a regime is participant sentiment, which very much depends on a narrative — something that simply won’t show up in market data so cleanly. (Forex is one of the best proxies for this, of course, but these indications play out months at a time for the most part. You can see my various posts about how I am a human USD/JPY top/bottom indicator, for example:

Since I started actively trading in 2014, I have seen ~4 regime changes, with the 5th happening as I write. You had the Trump reversal of post-08 Dodd Frank regulations undoing the lending freeze of the Obama/Yellen years, XIV’s blowup (which changed how options moved on lit screens pretty much overnight, coming from someone who’s been staring at options spreads for the better part of a decade now), COVID (of course) which redefined how retail behaves in markets forever, as I’ve written about on this site endlessly, and the rising rates/government spending-driven inflationary regime from 2022 onwards that led to a complete administration shift earlier this month.

On election night, I highlighted how I thought change was essentially necessary to bet on:

But, the thing about “nothing ever happens” is that someone has to make sure nothing will ever happen. You can’t just kick the can down the road and expect everything to be alright, and this seems to be what a large chunk of society wants. And who can blame them? An individual, or even a state full of them, is powerless by design to implement change at the federal level.

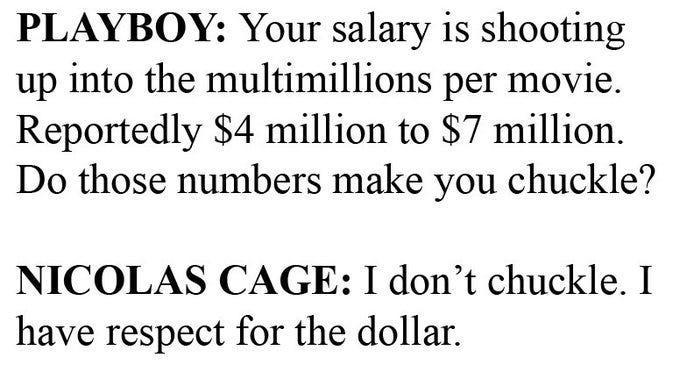

I consider myself a single issue type, but that issue is the sustenance and furtherance of the dollar, so it’s basically everything encompassed into one single goal. (Kind of like how the entire fiat economy revolves around a single interest rate, wouldn’t you think?)

I like the dollar, the dollar is good. I happen to have a few of them as well. I’m oft reminded of a quote from Nicholas Cage, one of my dark horse nominees for top-5 actor of all time:

Since the meme market of 2021, I’ve been wrestling with this question that money itself seems irretrievably broken. It makes sense in the worst way possible — the “attention economy” doesn’t create anything, it just sucks up mental resources and redistributes wealth in random ways that don’t reflect a net increase in productivity…

The solution isn’t more cryptocurrencies, defi products, or other ways of transferring risk in and of itself — people have to hear some good news and feel like they’re being rewarded for the work they do. In the absence of this, the only way to keep the mirage going is to keep printing money, and we are at the critical mass of not being able to do that anymore without deep, deep issues, some of which are already actively present. AI engineers and DoorDash drivers and unnecessary government jobs does not a healthy economy make…

Something has to change immediately, because we are at the point of a debt recursion loop. Look, you can cite whatever numbers you want, I am convinced we are not getting “true” 2% inflation again. Don’t just take it from me, Paul Tudor Jones arrived at pretty much the exact same conclusion.

Inflation, by nature, polarizes wealth. (This is precisely why the fascination with deflationary currencies like Bitcoin came into vogue post-08 — deflation preserves people’s assets.)

The change that I expect to happen is that “SPY go up” is no longer going to be the priority, at least not for 2025. I wholly expect government spending to “sector rotate” significantly, to use a market term, as the incoming administration is hell-bent (with the blessing of voters) on not kicking the can down the road by passing omnibus bills with more pork stuffed in them than the crowds at a Wisconsin tailgate.

This creates some obvious modifications in how I’m thinking about portfolio management, especially regarding my concept of the “four-stock port” I reference so often:

One of the most common questions I’m asked is “what stocks should I buy?”, and I consistently find it one of the hardest questions to answer, because I come from a trading background rather than an investment research one and philosophically disagree with the entire idea of stock-picking on the thesis of company outperformance. Investing in a financial context is traditionally defined as capital apportioned across assets for the sake of generating income or capturing price appreciation (or both.) While this could take a “what stocks should I buy” form from a layman’s view, what’s actually presented is a min-max optimization problem: given a certain timeline, how do I maximize exposure to a desired market while minimizing downside risk?…

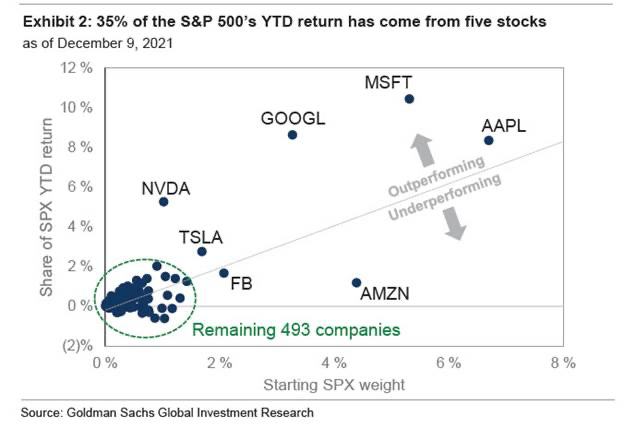

What this means is that the market cannot move without its biggest stocks coming along for the ride. In fact, that’s what drives the returns, as we saw in 2021:

As I noted then,

a sort of push-and-pull effect occurs: “real” flow goes into large caps, they rebalance as part of the ETFs they are in, “passive” flow goes into ETFs and drags the rest of the stocks up along with the large ones to a smaller extent.

But remember the optimization problem from earlier — AAPL and MSFT, the two largest and most reliable stocks in any index, have betas of roughly .9-1.25 (indicating the volatility of these stocks relative to the index — .9 would be MSFT is 90% as volatile as the index in the same direction for example.) while TSLA has a historical beta of over 2. If the index is going to move with these two stocks, it doesn’t entirely make sense to replicate this exposure through individual stocks without “compensation” for the extra volatility taken.

Thus we arrive at my philosophy: to “solve” the optimization problem (“given a certain timeline, how do I maximize exposure to a desired market while minimizing downside risk”) I posit two things: first, that “snapshot-driven value investing” does not move the market in day-to-day real time (but rather quarterly), and second, that any sector cannot move without its heaviest weightings following suit. So if I wanted exposure to financials, I’d look up XLF and note that without BRK or JPM, this sector is going nowhere…

The insight of this style of portfolio construction is that I disregard the idea that there is some novel insight to be gained in researching individual companies or that allocating capital to public markets is supposed to hockey-stick my net worth quickly. There are better venues for those goals, including novel trading ideas (immutable edge), starting a business, or private investments (with the requisite net worth and proper Kelly behavior.) I also disregard the idea that beating the market is a worthwhile goal — as I’ve noted about the S&P 500 before

there’s this misconception that passive funds are truly passive — take the S&P 500, for example, the most allocated-to “passive investment” and benchmark…

While colloquially we think of the S&P 500 as the “largest 500 stocks”, this isn’t exactly the case — otherwise you would see a constant updating of the holdings based on size. Instead, there are criteria that a committee uses to deem which stocks are in the index…

Which, of course, leads us to the profitability filtering, which rids us of this conundrum — in effect, the S&P 500 is essentially biased towards the best-performing companies. No wonder so many actively managed funds fail to beat this! They’re benchmarked against constantly moving goalposts.

Instead, I think striking a balance between generating an (ideally inflation-beating) return versus avoiding the full drawdowns of the overall market is a much more worthy goal. Of course, based on your risk tolerance/overall time horizon, you can prioritize the return versus the drawdown avoidance accordingly.

For the past ~10 years, dare I say, picking stocks has been kind of easy, all things considered. The entire year of 2019, for example, all I did was full port AAPL, and it just went straight up the whole time, thanks to VIX 13 markets. You could have just bought any heavy weight in QQQ and done great if you survived the initial 2020 drawdown.

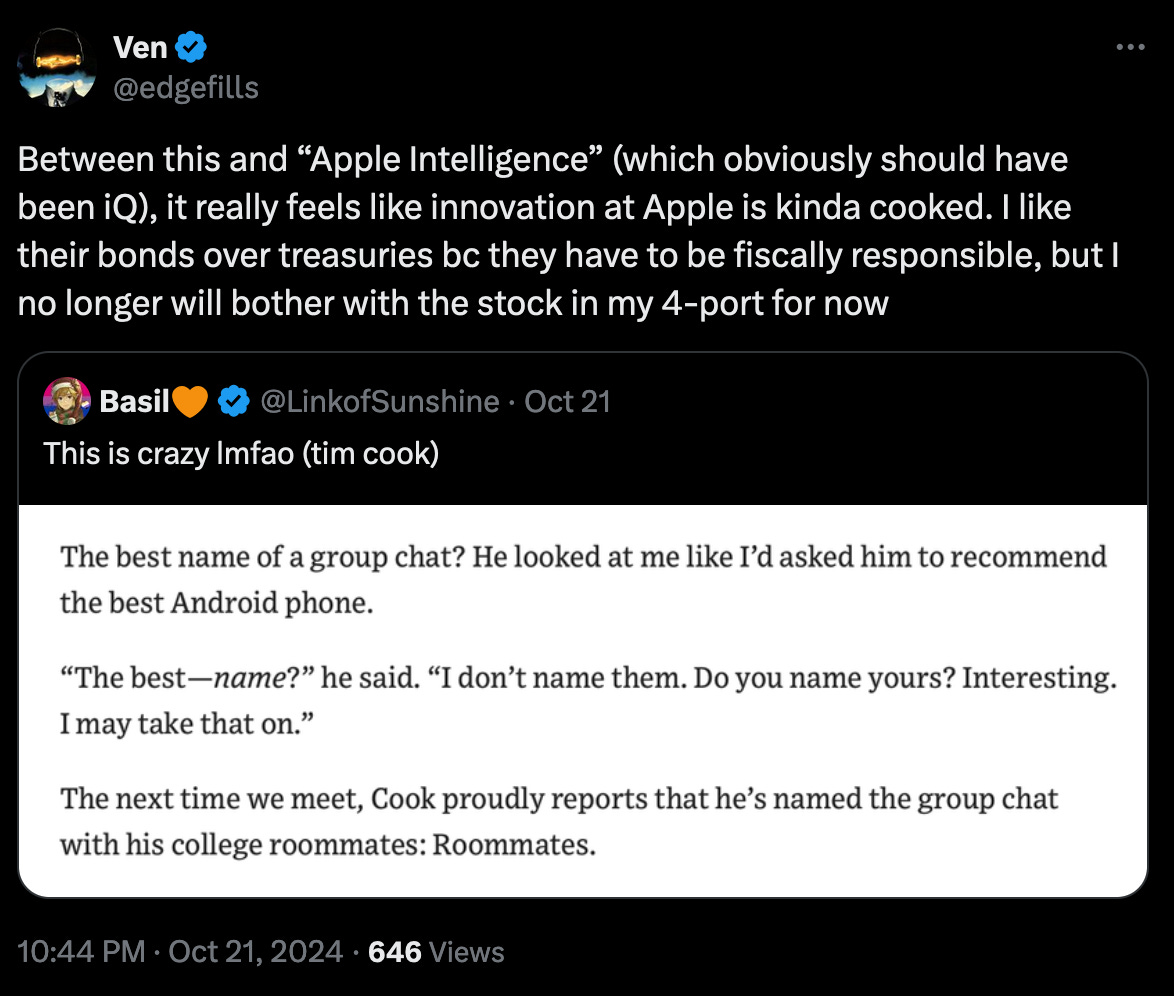

Going into 2025, however, this is the first time I’m not holding one of GOOGL, AAPL, or MSFT in 10 years. A strict regulatory environment only benefits the publicly traded CCP and the incumbents, but that is about to change. And when we take a closer look at what exactly has been driving these stocks upwards, is there any real explanation other than no other investment opportunity in the past few years had sufficient liquidity to consume? That we’re all trapped in the same trade, in a sense? All of these companies are incinerating money on AI, or, in Apple’s case, just bricking on innovation completely, and if there aren’t profitable deliverables hit by probably Q2, there are too many other places to seek a return at this point to justify just setting and forgetting big tech. (NVDA also critically relies on real products finally going to market and generating revenue — keep an eye on this one going forward.)

Furthermore, the “Trump trades” seem to be driven by a collective berserk mania post-election. While TSLA obviously is a must-hold at this point, given Musk’s ties to the incoming administration (and was the easiest pre-earnings pickup I think I’ve ever seen in my life), crypto-mania seems completely out of control.

And if you’ve been following the pump.fun shenanigans, if that is what persists, it’s obvious no politician is going to stick their neck out for anything other than bitcoin — and what benefit does BTC get from dereg? It’s already gotten past regulators, there’s no more saturation other than the US government outright buying it, which doesn’t really make sense to me. There’s also the simple fact that tax optimization is “free alpha” — if you expect taxes to drop, then the entire EOY before inauguration would logically be spent maneuvering accordingly rather than building up sizable, fundamental positions, as I wrote in a message the other day:

Thus, at least until I get some clarity on how the regime will shape itself, I’m going to proceed cautiously, and not benchmark to the S&P — instead, I’m going to use a money market fund as baseline, as rates shouldn’t drop so fast such that it lags my estimate as to what “true” inflation is (which I have pegged at ~3.5% on the high end right now mentally.) It’s not the end of the world to miss out on a big S&P pump here and there, but it is incinerating money to not be allocated at all times one way or another in an environment where inflation is going to persist. Of course, this means that you have to have a strategy for short-term capital gains, which can be framed as “will my allocation outpace 3.5% and my income tax rate over the lifespan of the trade?”

I’m cautiously optimistic that, if S&P green days aren’t worshipped going forward, markets may end up in a much healthier place a year from now. Guess it’s time to assemble a team.

If you’re also of the opinion that very little of the actual mechanics behind Inception make sense, just like markets, feel free to share this post or forward this email

🔥write up. I’m not macro guy and I am ultra short term trader so it doesn’t matter to me as long as Vix stays at least in double digits (Obama market was fucked)

I kinda think we can be in a super long term late stage cycle, in the bubble part if you will…. What are chances that this fucker keeps rallying and then blows off in the beginning of next year when the feds missteps start to appear in cracks and crumbles? I think there’s a chance much greater than zero that we can really blast off and then have a proper 1929 style crash. (Not sure of timeline but I would guess 3-18months? I think whoever the next president was going to be was walking into a ticking time bomb and the “kick the can down the road” was gonna run out of road anyway.

Could be totally wrong and retarded and it’s not actionable (aside from holding longs and maintaining hedges, and blasting calls out on dips)

A real market crash and economic crisis will be a huge gift to democrats for years to come too, so gotta think they wanna see Trump fail hard. Idk, but I feel like I can kinda seriously see something like that play out…