The Sweet Escape

If I could, I would

I mean, really:

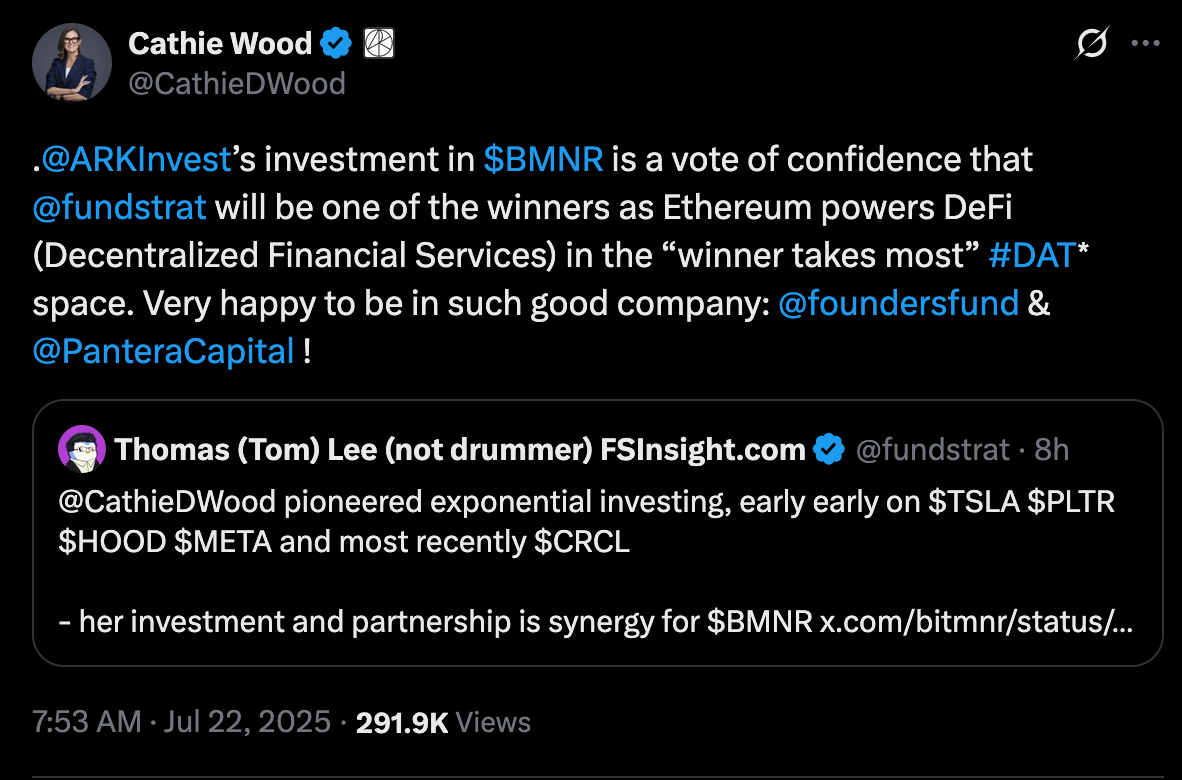

What are these new strategies?

Of course, it means to take over a publicly traded shell sell bonds/issue stock, flip a (real) coin and buy either BTC or ETH, and become a “treasury company”. (Note that this is nothing new — 2010s biotech was the precursor to 2021 SPACs which are the precursor to the newest exit scheme.)

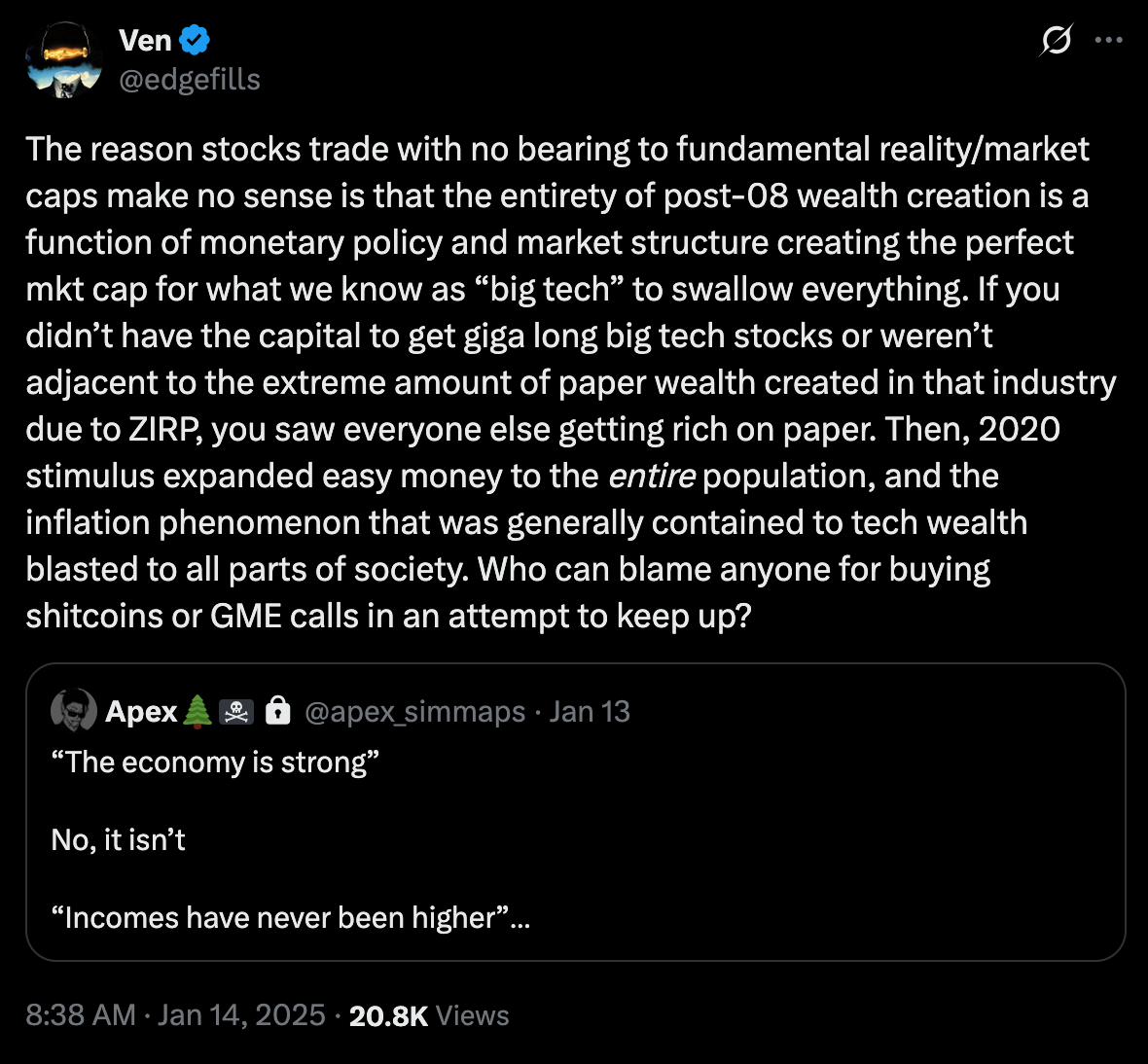

What are we even doing here? In my extensive ramblings on the concept of money, how it relates to productivity and the real world, and more, there’s this underlying belief that the purpose of it is supposed to be a means to an end, to facilitate productivity.

But when dollars are untethered from productivity, we get a different form of thinking, where Paris Hilton is more of a pioneer than Benjamin Graham. No longer is future cash flows the driver of valuation, but rather how much attention paid converts to bid

And, as a result of everyone with a pulse and a brokerage account being tied to this ecosystem, and everyone else’s jobs hanging in the balance of this bid, this entire blog exists as a kind of dissertation working out what “liquidity as fundamental value” means…

This blog talks a lot about liquidity-as-fundamental-value, but let me be clear: that’s fucking stupid at its core! …the whole reason it took hundreds of blog posts to work it out coherently is that so much of it is facially nonsensical but for the fact that retail trading is what drives markets nowadays. I still prefer paying with an American Express card rather than a browser wallet. And, collectively, you are kind of seeing the market realize this year — at the end of the institutional adoption road — that all of the hype hasn’t amounted to any actual use cases beyond the originals

I have never seen trading reflect societal nihilism so cleanly. Outside of AI stocks, crypto, gold, and your random meme stock pump, the broader market sees maybe ~15% of the activity. Everything is concentrated to the point of absurdity to the point where “bubble” is officially my least favorite word. It’s not even hard to notice the innumerable ones forming aat this point, and when I sit down at my regular bar stool, order a Miller High Life and stare forlornly into the distance like “Oppenheimer” himself, only stopping to take a glance at the carbonation percolating,

I think to myself “well, at least I can do something about those bubbles.

Look, this only ends one way. You already have outright communists being favored for mayoral positions in American cities. It’s obvious that every high-earner has fled, so you have game-theory-optimal voting for more welfare benefits, hoodwinked people that there is a “rich” to tax while staring in the face of their crippling student loan debt, and Gossip Girl types larping as Che Guevara revolutionaries prancing around as the last people in Manhattan.

In the meantime, until everyone comes to Jesus at the exact same time, the markets simply trend towards such a high level of concentration that I don’t think you could legally package it and sell it as juice:

And what this means is that the market will trend towards

-Publicly traded CCP (as they’re the only ones who can afford to build foundational models, but more on that another time)

-publicly traded Private Equity portfolios propped up by 401ks mark to market

-crypto treasury companies

while my small cap value stocks still won’t bid even though there’s nothing else “fundamental” to invest in, until the music stops.

What is even the purpose of having publicly traded equity at this point?

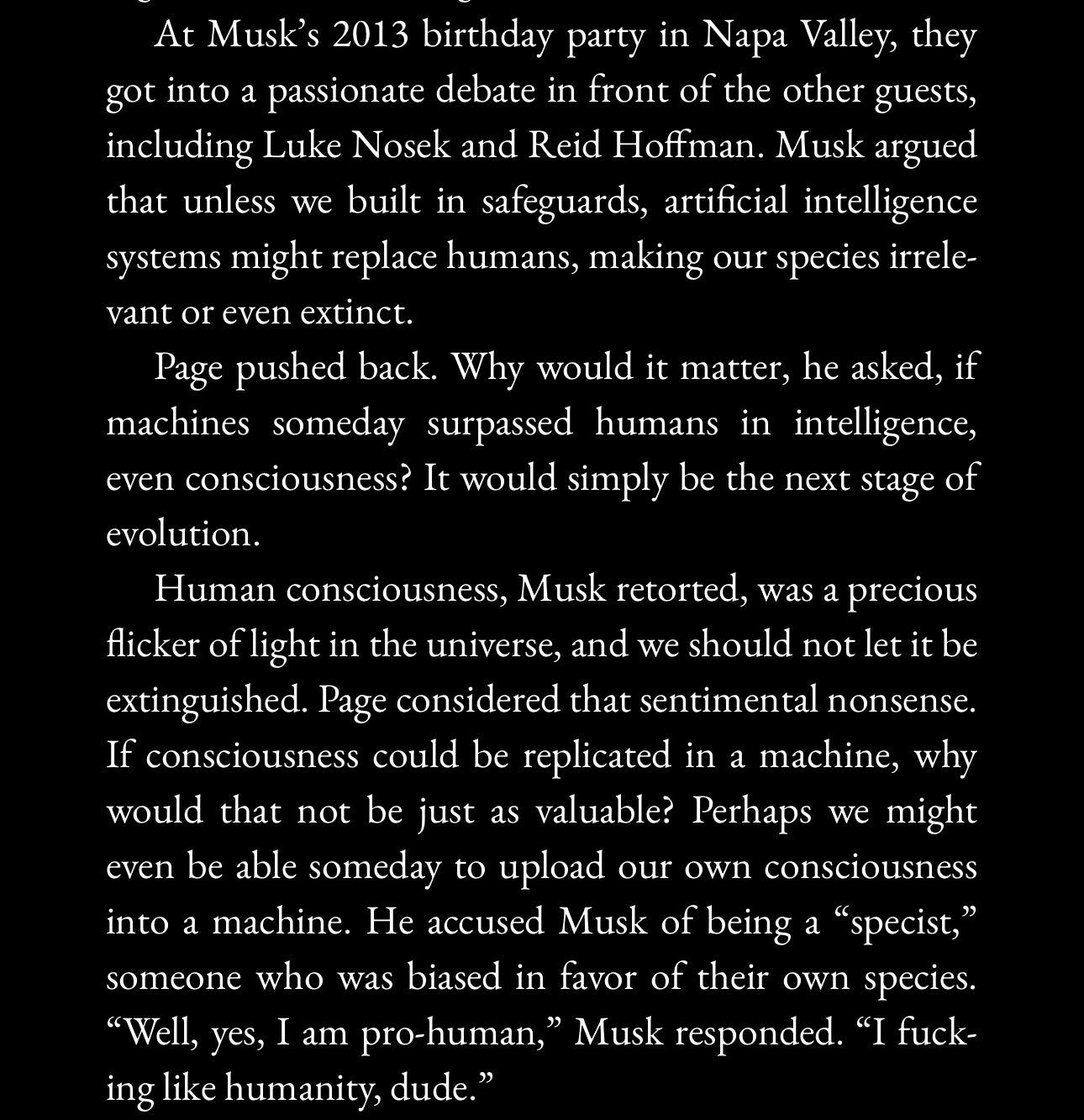

Look, I am a believer in the AI “warp” — I’ve personally seen what this can do, work with it constantly, and am in the process of uploading myself to the cloud. The core problem is, what does this mean for everyone else? 99.9% of people won’t find any sort of real use case out of this, and if finance doesn’t become invalidated, this surely means that wealth is going to hyperpolarize even beyond what it already has. The meta that is almost certainly going to die is the 1-1.5 sigma section of society because they are the most likely to be current-day high value credentialed specialists, and the value of that skillset simply has shifted.

If the gains from this technology are not properly distributed — and I don’t see how they can be — then it ends the same way it always does. There’s a lot more “have nots” than “haves”, and if you can’t defend yourself by hiring people, who’s stopping them from taking your stuff?

Unfortunately, there is no more asset flight, no second passport. Mark Zuckerberg and Larry Ellison own all of the bunkers in Hawaii, and Thiel owns New Zealand. We’re not just trapped in the dollar — we’re trapped in this hellscape of big tech realizing that they were handed the keys to the kingdom through zero rates and used it to sell ads and Save our Democracy.

Do I believe that the CEOs spouting off absolutely incomprehensible drivel to avoid actually explaining what the ROI on this level of CapEx is actually know something? Or do I think that the people who have driven NVDA’s stock to price in 40 years straight of selling chips hot off the presses are desperate?

Dude it’s Jevons paradox. It’s literally Baumol’s cost disease. A classic example of Gell-man amnesia effect. Oh that’s the Monty Hall Problem. It’s orthogonal to Dutch Disease. It’s the Prisoner’s Dilemma. You’re a prisoner. You’re in prison. You’re imprisoned.

If there’s one thing I understand better than anyone, it’s the implicit leverage and risk tied up in this entire “stick your hand in someone else’s pocket” ring-around-the-rosie economy.

So when the AI engineer posts look like Woj Bombs, is it really the case that there’s inside information? I don’t think I’m being paranoid in thinking that there’s virtually no more money to spend without extreme results. We’re reaching an inflection point, and I think it comes at the latest by end-of-2026 (though I suspect it’ll be far sooner.)

On some level, it makes sense why athletes are paid gobsmacking amounts of money. (Well, every way I calculate it, most supermaxes make no sense to me at this point, but I digress.) But when you see 9 figure sums being thrown around at engineers for no discernible benefit… I mean, does this make you feel good? What motivation is there to go schlep through emails, meetings, and daily annoyances when the people making the most promise to automate everything away with a “superintelligence” while actively making every part of the internet ecosystem worse?

After ruining tee shot after tee shot due to intrusive thoughts, I figured the only thing to do is just heads-down and complete the vision I have in my head. In the meantime, I can’t just sit around and wait for this nonsense to pass. If money doesn’t reflect productivity, then I might as well consume it. Accordingly, I don’t think the tech mirage lasts through Q4 earnings, but I have a pretty good feeling about my “existential dread” thesis through the rest of the year.

As for what I’m desperate about, I don’t really care to see any massive leap in the next year — I just want the maladaptively social types to not control the weights of the future.

Indeed, I think we can make it better.