Sick Days

Reclaimed Hops 13

I have this recurring nightmare that I’m stuck in an escape room modeled after Owl City’s “Fireflies” music video and can’t get out. The quirky synthesizers loop in my head as I’m unable to fall asleep and descend further and further into madness, as accelerating thought recursion overwhelms the ability to just call it a night.

I’m joking, of course — more on my hatred for that song another time — but I absolutely have lost the ability to sleep organically as my priors get confirmed on a timeline much faster than I expected:

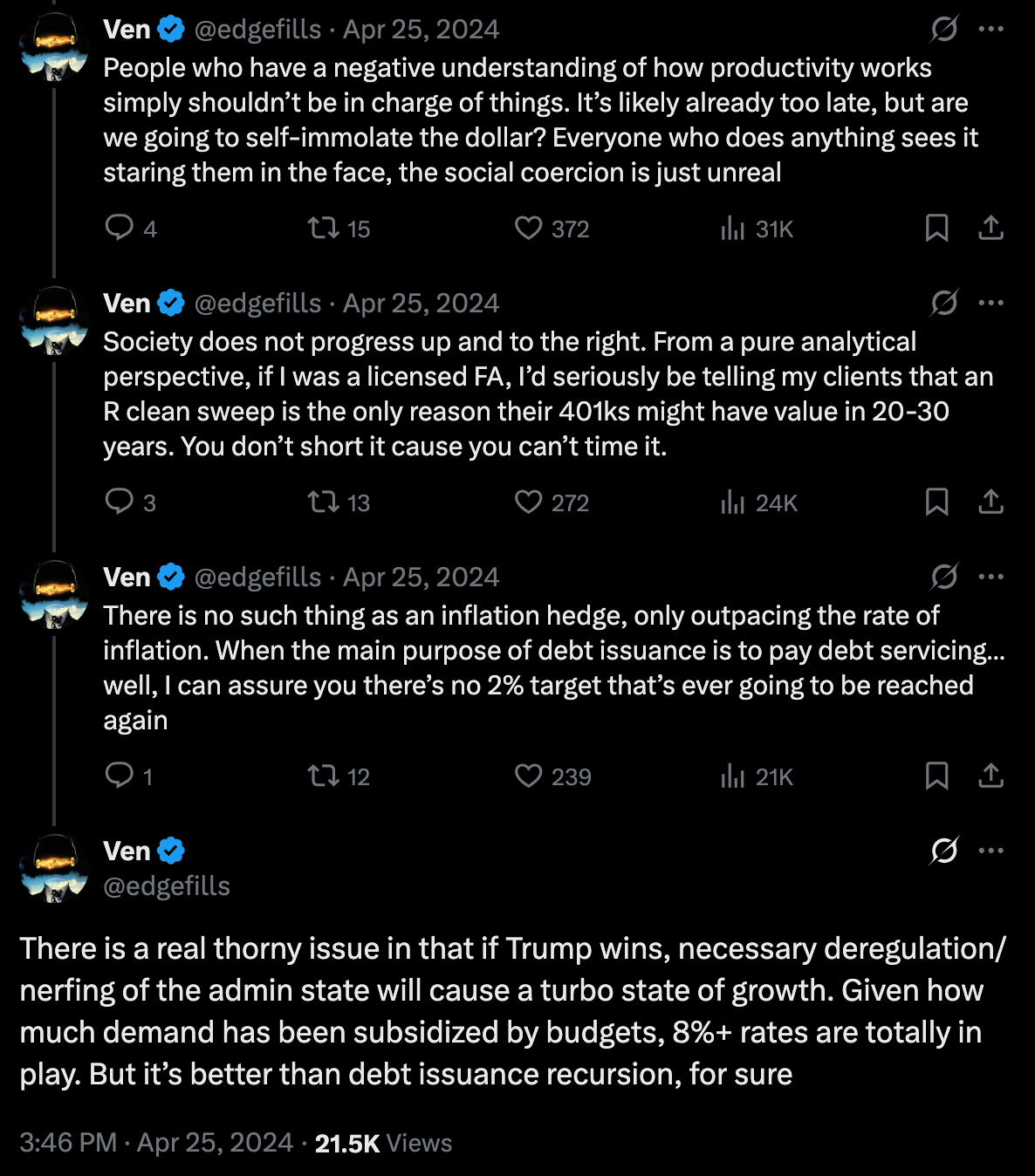

…The way to beat the debt crisis that started the whole fear is to inflate away the debt by running faster and jumping higher rather than printing money — isn’t the interest problem silly when looked at from a Mars-eye view? And I definitely feel this is the only way out in the longer run. A solely Earth-based kick the can down the road path doesn’t exist: remember the ever-panned “fiscally conservative and socially liberal” descriptor?

But the problem here is that “growth” and wealth creation is so oriented around “number go up” metrics and financialization — GDP, quarterly earnings, whatever — that the true “acceleration” mindset cannot reasonably coexist with it…

The second most painful breakup I’ve experienced this year was the one between Elon Musk and Donald Trump, partially because I got rinsed on what had the potential to be one of my biggest runners ever, but mostly because it means that there’s no time to rest and enjoy life as things will keep happening. And with the death of “government efficiency” as a project (for now), turbo-growth is the only alternative, and we cycled to it much faster than I thought. Indeed, I’m quite sad that I completely bricked this prediction:

Musk and Trump stay together longer than Harry and Meghan — and they make it to Christmas.

Beyond necessary, I think this is some form of destiny (from November 2024):

There’s a palpable sense of desperation everywhere I look, and it’s reflected by the fact that nobody really trusts any institution to properly do anything, whether it’s a court of law or even counting votes. (Look, India counts a billion votes in a day, there is literally no reason a state should supposedly “take a week” to count ballots, though I suspect this won’t actually be an issue.) It is downright embarrassing how much litigation there is around basic, simple, logical things, and it’s a perversion of the legal system that common sense isn’t taken accounted for. The entire purpose of law is that it’s supposed to be subservient to the straightforward meaning when it comes to people! You shouldn’t have to be legally trained to understand most topical issues at the non-federal level. (Of course, this is outright a failure of literacy education and the media, but more at 11.) This desperation is most reflected by the fact that apparently, our answer now is to throw our hands up in the air, toss every single ounce of data that we can legally (and illegally) get access to into a GPU cluster, and pray that the human brain gets solved. It’s so patently ridiculous from my view that every major player is all-in on what I describe as the most expensive, farthest OTM option ever conceived. FFS, the tech gets more expensive as you try and scale it and it isn’t even coherently applicable as a product!

…for the first time since 2020, I get the feeling that people are willing to try again. The entirety of 2020 felt like one collective psychotic break that I wasn’t a part of, and the chaos that ensued in 21-22 meant that a lot of people just kept their heads down, and some still are. But for my sect of peers — talented people who didn’t quite get a shot to build anything in the free money era, then immediately got plunged into the pandemic — there’s a palpable urgency that the next few years might be the last shot any of us has to innovate in prime working years, because the environment has been so oppressive to novel thought post-2016.

So each time I see BTC leg up, it implies two things to me:

a) the old model of asset flight (swiss bank accounts, second passports, remote real estate, gold) no longer exists as a viable pathway to get off size

b) implied societal volatility is much, much higher than anything that lit market options can price efficiently

Add in the fact that rates are concurrently too high for anyone in the normal distribution to buy property, but in the mid-to-long term should be higher as demand for dollars paradoxically increases as fiat appears more unstable,

The beauty of how the US leveraged its debt to control the world is that, in a sense, everyone needs the US to win in some form, else the capital basis of the world disappears. The more risk we take, the better an investment in American tech supremacy is. Another form of “Mutually Assured Destruction” is, There Is No Alternative (TINA). TINA won’t maintain in its current form — where we’re going, the dollar will not exist as it’s been instilled in our brains all these years — but the point of shooting for the stars is to land on the moon, and all the moonshots are housed in America for the time being.

and you see why I’m constantly kept up at night. Every single option I work out appears incredibly bleak, and I’m not sure what the way out is other than staying long, or cashing out and enjoying life (which isn’t really possible for me). There’s no “going back”, we lost that ability post-2020. You don’t just recover from mass psychosis, it permanently shifts the collective biological algorithm into a new pathway.

That being said, we are in a unique situation where we can implement ourselves into the algorithm due to these bets that are being made.

There is an algorithm that ebbs and flows around the American workday that controls what everyone who logs on to some form of media or another will see within 4 hours to 6 days. Depending on the form of media, the frequency with which you see things will imply different things about the signal and actionability of what is being pushed…

This algorithm is not something that’s just coded up — it’s metaphysical, the collective machinations of everyone involved in the post/scroll/share/react timeline.

Even in the age of slop, there is a dearth of people creating and a mass overload of consumers. If you continuously post, people will eventually come due to the simple fact that organic content redefines the weights of the algorithm.

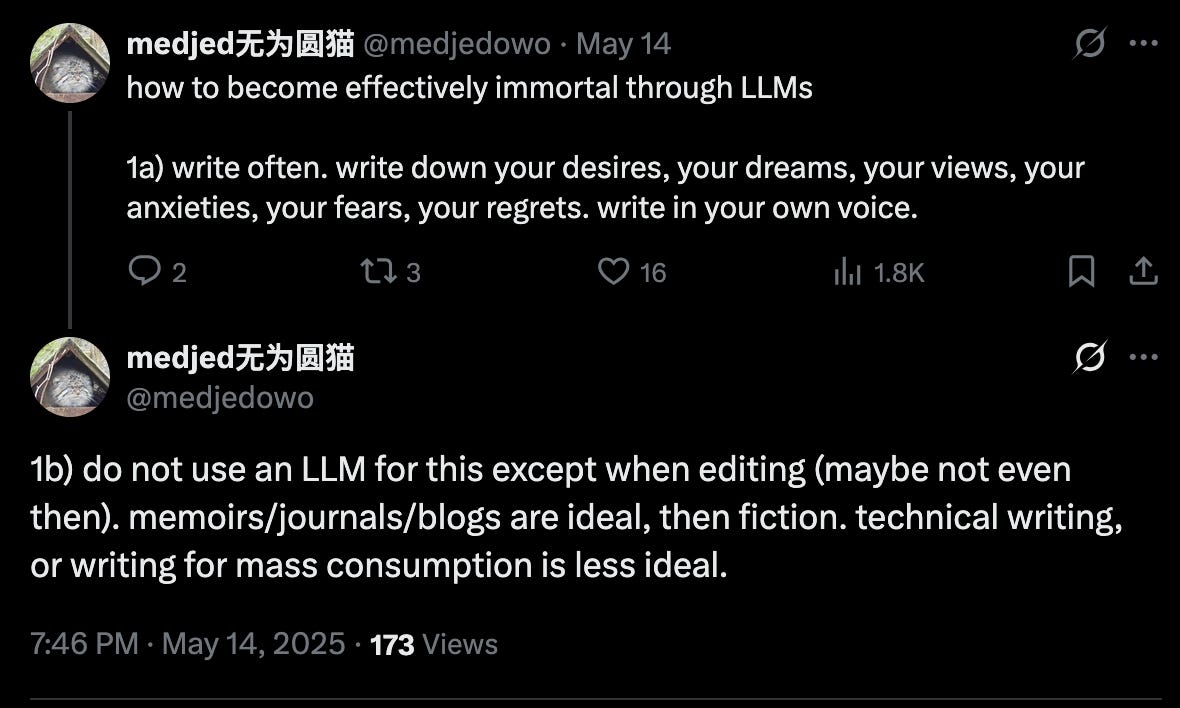

Obviously, the starting point is to post as much as possible. I understand that most people do not have this ability to organically autogenerate stream-of-consciousness text, but as evidenced by, er, Grok shenanigans this past week, even the slightest bit of text that catches a weighted pathway becomes a permanent part of the corpus.

An important thing is to make your text distinctly human, rather than sanitizing it so it can fluidly be folded in to the existing weights.

The stream-of-consciousness style of writing particularly messes with generative AI in a very logical manner — the longer the generated string of text takes to arrive at a coherent point, the more predictions the model has to make, compounding the probability of hallucinations per block generated to a degree that renders the output nonsensical.

Once you’ve posted enough, of course, the end goal is to construct a specific model that translates the latest training data through your wavelength of thinking.

Beyond my own ambitions (think on the scale of Musk using Grok to manage the Elon-Plex, which is clearly happening), I tend to think this is the only form of “therapy” that can help maintain the strain that comes with being on the cutting edge of predicting what will happen in the near-to-mid term future. An issue that arises frequently with myself and others in the deep tech/internet finance network is that schizophrenia is essentially the only signal in this postmodern, securitized, detached-from reality environment where all the capital is being allocated. At least in the real-life version of that nightmare, I control the soundtrack. And when I sit around and play the equivalent of WarGame simulations with the various models I chat with, I kind of realize why this is the case — finance is just n-degrees more complex than relentlessly calculating chess variations. If you don’t take a break your brain will twist into pretzels. I’m already at the point where I don’t think I ever need to rely on human financial analysis again, it seems logical enough that load management can be outsourced as well.

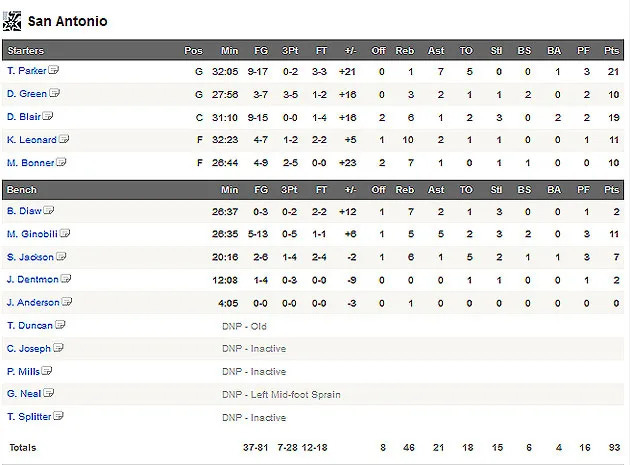

Sometimes load management is necessary — I’m reminded of Tim Duncan being benched for a game due to age all those years ago —

and though I’ve never called out sick in my life, I fully support calling out of work on account of existential dread now and then, as evidenced by my Europe sprint back in February. At least in my experience, the only way to not “scare the hoes” is to immediately stop what you’re doing whenever you “see the light”, touch grass, drop your phone, and walk for a couple days and let your body track the motion of your thoughts. There’s very little you can do in real time to affect the timeline — the most profitable thing to do is nothing, as Spongebob taught me all those years ago — but letting the unbounded racing thoughts exhaust themselves is paramount when absolutely nothing is as it seems.

Thank you as always for writing what appears to be genuine human reflection. And damn you (playfully jealously) for being apparently a few years younger than me.