Stimulation Theory

2025 Year In Review

Apologies for the delays on this post — I’ve rewritten this mentally at least six times since Christmas, mostly because I did not want to make another AI/dollar debasement/legal balkanization post, nor do I want to talk about the algorithm (for the time being.)

But what I wrote in early 2025 captured pretty much everything about how the year played out:

Politics has always been a means to an end, but accelerating without defining the parameters with which we think about has disastrous consequences if the people at the top simply haven’t done the requisite thinking. Thus, the conclusion is obvious — if you have ideas, no matter how formed or densely thought out they are

,you have to post. Until the dust settles, this is an all-time high in the conceptual volatility index, and everyone involved is scrolling nonstop

And the dust did not settle — instead, the timeline accelerated more, where the events of September made it explicitly clear that taking internet discourse to the mainstream has fatal consequences, and the beginning of 2026 has indicated that the train keeps chugging along.

And while I could have spent 10,000 words just quoting myself on everything playing out as I thought, saying “do you see” again and again,

I don’t see much of a point. I very clearly felt in September that the public internet was ended violently,

There’s nothing new in anything I’ve written since I found golf to be too boring — indeed, the patterns are so obvious and clean that it’s very obvious how algorithmic reality and actual reality has converged.

You need there to be enough uncertainty in the market so that there is organic flow to market-make.

In a sense, everyone is “market-making” when they interact with public markets. Proffering an idea fills the proverbial orderbook just like an order is made or took in the level 2.

given that it’s simply too risky to have a public profile. As such, I kept putting off the normal “Year in Review” that I’ve been writing since 2021, not because I don’t want to make predictions, but because it’s actively negative to both my own interests and society’s to keep publicly pontificating. This is not out of a sense of altruism, but of precaution: when there isn’t a clear way to bet on the “big question”, it results in unfalsifiable, never-ending, pointless debates. AI discourse has taken the same format as politics discourse for this reason — there’s no good way to invest or speculate other than cheap, rudimentary Lodden Thinks knockoffs through bullshit benchmark betting. When was the last time you read anything of substance?

The second part is, if you commit to doing “content”, you have to have a take to keep any semblance of relevance in the algorithm. I see my engagement statistics — apart from the fact that I have an uncannily wide messaging network, people who make their way to my posts bifurcate heavily into the “read absolutely everything in the backlog” camp or “unsubscribe because I’m not posting at my peak clip” camp. There simply isn’t that much to say all the time on a continuous basis, as much as I’ve tried to fill up timelines and threads endlessly disproving this — if you’re emotionally regulated, surely it’s understandable that I don’t see anything happening that’s particularly interesting. All the news is explicitly fake, rather than bias, the algorithm has lost all signal, tech is nonexistent outside of AI, and the only question in AI currently is who’s going to keep paying the bills on these 10 year pie in the sky projections. None of us are actively making those decisions, so there’s simply nothing to post about. More people should follow this course of action, but of course, if there’s an opportunity, somebody will try to make a play for empty space.

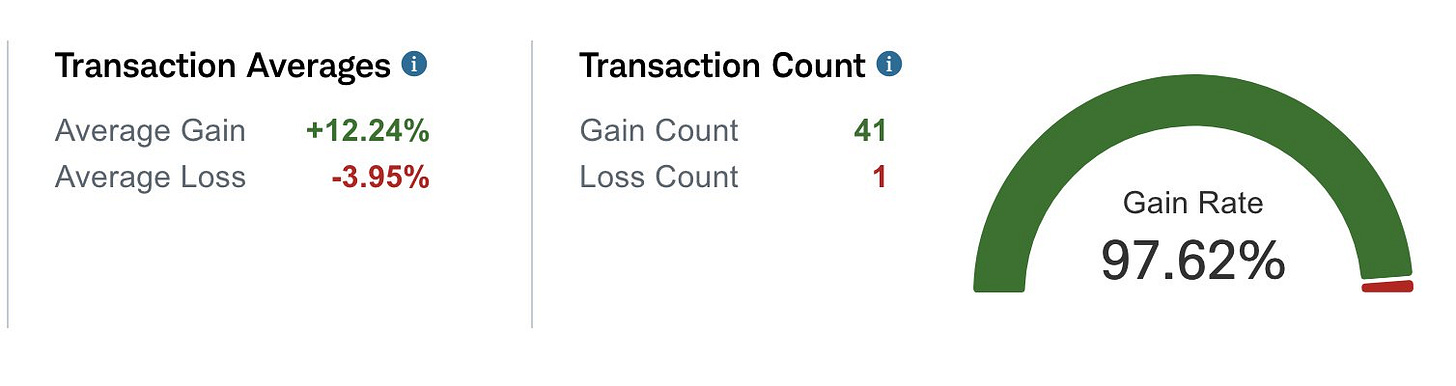

So, this “Year in Review” is more of a personal reflection, and a communication of future intentions. Apart from obsessively playing golf and building clubs (after 8 months of gearheading, I finally have a complete bag), I’m fairly confident that nothing “new” will come in the algorithmic realm until the definitive questions surrounding AI are resolved with money. Debt will come due, deals will be signed, some potential IPOs will fail, and then maybe we can start allocating capital efficiently again. In the meantime, I’m in a bit of a transitional period. I have essentially nothing left to prove after a year of perfect trading,

and I’m sick of looking at screens after 11 years of being glued to them. Working for yourself is great — you always have perfect feedback, and you own what you keep — but the structure is limited in that you simply can’t scale your ideas without marketing them. And while it’s been great to be the person who can always say what I think for the first three decades of my life, it’s not going to ever move beyond the Malt Liquidity format if I don’t change things.

There’s another kind of feedback that’s good — whether people are paying for your ideas or not. Subscriptions are temporary, simplistic, and one-way, while a properly mutually beneficial relationship requires value added in both directions. And over the course of many months of reflection, I realized that I’d much rather have client feedback than try to coax out coherence from the mess going on in people’s brains, where people want to be told so badly what to do and think. For this, my style of writing has to change — if I want people to invest alongside me, or take my advice, I also have to stop telling everyone precisely how the world could burn down. I like to joke that a financial advisor is a therapist for money — well, it’s also the therapist’s job to keep all the negative stuff to themselves.

And that’s why this post has been hard to put out, in a sense. It’s a commitment to not posting my trades, charts, performance, whatever anymore. I used to use it as motivation, but that kind of motivation is counterproductive from focusing on building an organization that allocates and scales, that treats proprietary thought in a need-to-know fashion. In a sense, this could only make my writing better — just look back at the Cracker Barrel post, I knew I was falling into a comfortable frame of thought again — but it does mean that I need to learn how to generate topics again.

All this sounds like a very dramatic way to say I’m working on setting up a wealth management practice — I assure you the scale I am thinking is far, far beyond that, but there’s some element of not reinventing the wheel in play here. I have too much expertise in markets to just let it sit in my head and percolate and become irrelevant. At the same time, I’d like to take people golfing, take some meetings in the sun, and enjoy the actual client side of life that I’ve always been on the ringside of. I didn’t spend 9 months gearheading and building a bag for no reason!

I frequently think back to my own “Lee Sedol” moment from earlier this year:

and I think it hit the nail on the head as to how we’ll have to conduct ourselves to prevent our brains from being fried in the next couple years.

We can extend the concept of liquidity theory

Liquidity theory: An ought becomes an is when there is a sufficient amount of speculation as to whether an outcome is or ought to happen.

to what I’m going to call stimulation theory:

Stimulation theory: There is an optimal threshold of understanding what ought to happen without materially impacting your quality of life past the point of efficient returns

Obviously, this is an incomplete thought, and needs to be worked on a bit, but I think this is the quintessential problem of the future of wealth management, business management, trading, and more — how do we scale information processing pipelines to make informed decisions without having to engage with toxic flow or manually label signal and noise ourselves?

More to come on this soon — I hope to write at least once a month, in a longer, coherent, more structured format, eventually building a sort of “manual” that generalizes my own personal ability to read, write, and talk nonstop.

Thanks for reading, as always — 5 years with a format was a good one. While predictions and accuracy/sanity checking yourself is a good habit to have, it’s also a good habit to end after you feel enough is enough. None of us have a mandate to keep on speculating — sometimes, you just have to realize the gains in real life and find something else to do.

Stimulation theory, as you coined it, has been something that's (probably to my financial detriment) put me off of "information processing pipelines" completely. It's maddening to spend more than fifteen minutes online - especially if you allow the algorithm to make a single decision on what you see - without a highly curated pipeline.

I hope to see a post elaborating on your question "how do we scale information processing pipelines to make informed decisions without having to engage with toxic flow..." In the meantime I'll catch up on the posts of yours that I've missed, stick to books, and my journal.

Also: post a pic of your sticks! I need to see what nine months of Ven gearheading looks like.

Respect it, man. Takes some serious self-awareness to pivot like this