Crack a Barrel

You just hit the lotto

Thankfully, I’ve been able to point to the summer as a “break” rather than a severe case of writer’s block. Ostensibly I have been exploring the questions of retirement, existential dread, and purpose outside of “work” — not that I’ve ever actually worked in the traditional sense — but truthfully all I’ve learned is that it’s much harder to break the loop that you build for yourself than you think.

Most of what I’m struggling with comes down to the fact that I simply have nothing left to prove to myself anymore. There isn’t a game or a surrogate activity that I can properly test my mettle with, and the world is not in a state of growth, but rather destruction. It is pretty obvious where things are going, as I wrote about in “Fathers and Sons” all those months ago:

A function of excessive luxury is that people become lazy, and there’s no greater evidence of this than the broad illiteracy of the American population, even (especially) amongst the credentialed. Russian grade-schoolers read Tolstoy, and we have Disney adults. On October 7, 2023, I became certain the world would re-align, because the “trick” that maintained peace in the post-WW2 world was about to become heavily scrutinized.

I could (and have) write tens of thousands of words as to how attention has become the driver of what essentially amounts to random wealth transfers manipulated upwards by “economists” and “central banking”…

Every core American institution takes religious design and translates it to a secular construct. The very word “unconstitutional” is an unfalsifiable “you either get it or you don’t” signal, which is precisely why power was gatekept in such a clannish fashion by licensing boards. America is a pretty high IQ concept — it’s both a land and an idea, a parallel construct where subservient proxies determine the best course of action. If you look at how the judicial system used to treat judges as sacrosanct, or the meaning of making doctors take an “oath”, it becomes very clear that the true nature of operations of a functioning institution are clandestine and cannot be studied in school.

Our institutions failed because debates about their intricacies became a campaigning tool to the masses who simply don’t have the memory or the abstract reasoning to keep track of things, combined with the fact all of our trusted credentialization mechanisms were hollowed out by pure greed.

This is why a core axiom of mine is “Artificially subsidized cost of capital has risk transferral externalities”; the risk is that everything becomes a capital creation game rather than a growth game. We really don’t live in a free market, indeed, I don’t think there is such a thing (as outlined in “A Little Dark Edge”). The government has been picking winners and losers for longer than I’ve been alive — the way to win is to creatively destroy what is entrenched and then rewrite yourself as part of the regulatory capture facade.

If you refuse to acknowledge the religious motivation at the core, another religion will supplant it. Humans are creatures of faith and belief, intuition is not explainable by any rational mechanism. When conservatives argued for tradition for the sake of it, and the common sense that logically constructed those traditions were forgotten, it only took one moment of “going broke” for another entity to take control.

Over the years, I’ve come to realize that studying theology is basically the same thing as studying law, the secular translation of the model. There is no faith in this system anymore, whether it’s courts, the dollar, whatever, as I pointed out about a year ago:

When idiots go flight or flight mode, it results in bodycam footage (warning: graphic content).

When millionaires are in fight or flight, it results in political instability. A signal of Eastern bloc instability is when ultra wealthy people start randomly dying — a particularly noteworthy one to me was the “sausage billionaire” being executed in his sauna by a crossbow. I started to expect something major to happen after, and of course, Russia invaded Ukraine. Rich people war over their respective pots when there’s no wealth creation — the domestic instability resulted in another pot being sought out. (Oddly enough, 2 years later, another Russian sausage billionaire died after falling out of a window in India, the Moscow special. I guess they knew too much about how it was being made.)

I’m not sure what form the American millionaire battle will take. The amount of interparty vitriol leaking out to the media is already a bad sign, and depending on how nasty the argument over the nominee gets, you’ll get a good idea of the overall temperature. I’m pretty sure it’ll happen through courts, though, similar to how NY tried to “get” Trump (See: Trading in the Age of Meaninglessness, 3/25/24). Too much can be manipulated in the court system for jurisdiction purposes. (Consider the case of Douglass Mackey, one of the most egregious 1a social media cases I’ve seen.) Nobody ever argued that America isn’t a litigious society first and foremost. There is so much bad blood at this point that I’d be very surprised if things just quieted down after November, especially if Trump wins (as I predicted my 2023 Year-In-Review post, with some conditions.) It’s already started, but I think a mass flood for “safe” jurisdictions will happen. You are likely going to see ~3 big legal wars:

- State tax clawbacks (e.g. CA demanding payment to move a business out)

- incorporation fights (Delaware is no longer as predictable and business friendly)

- compliance/physical requirement deregulation (all the NE has going for it at the moment is proxy to Delaware and the physical data centers.) Keep an eye on the Citadel-backed Texas Exchange project.

There is a decent chance the power structure shifts to the southwest in the next 5 years. Proximity to established CA money is imperative, and it’s easier to fly to TX from, say, Vegas than NY. But being in CA is untenable as a business until the state is reformed from the top down, which is unlikely to ever happen, imo, but at the very least will take 5+ years of legal wrangling. FL simply doesn’t have the infra for big business in the same way, and it’s pretty inconvenient to fly to. It holds value if proximity to NY holds value, which is what I’m betting against. I’m curious to see what state tries to replicate TX next. If R’s get control of AZ (Blake Masters, as unlikable as he is as a candidate, is part of the Thiel network as well, which seems to be dictating the moves of the GOP), I can see a bigger push as chip fabs/high tech manufacturing is already there across the state.

It is blatantly clear that multiple jurisdictions are unfixable. Really think about what the federalization of DC entails — it’s a test run as to whether deep blue jurisdictions that have long been out of control can be fully defenestrated. CA, WA, CO, and IL are unfixable — Kafka was the last person to truly get it, that you simply cannot fix an institution that is broken from within.

I have spent the entire summer trying to put these conclusions out of my mind, but it turns out that it’s impossible to just golf and ignore the world when you’re so used to being plugged in. I felt bad about ranting about “the happiest golf course on earth” in the manner that I did, but then I logged on to X Dot Com and saw the Cracker Barrel logo discourse take off.

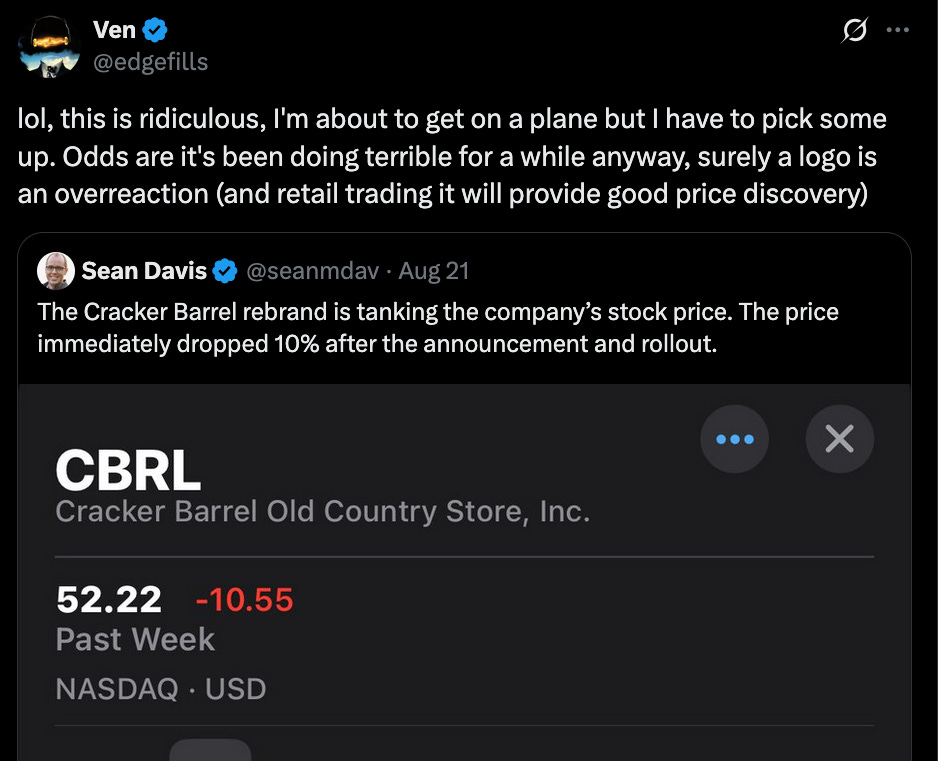

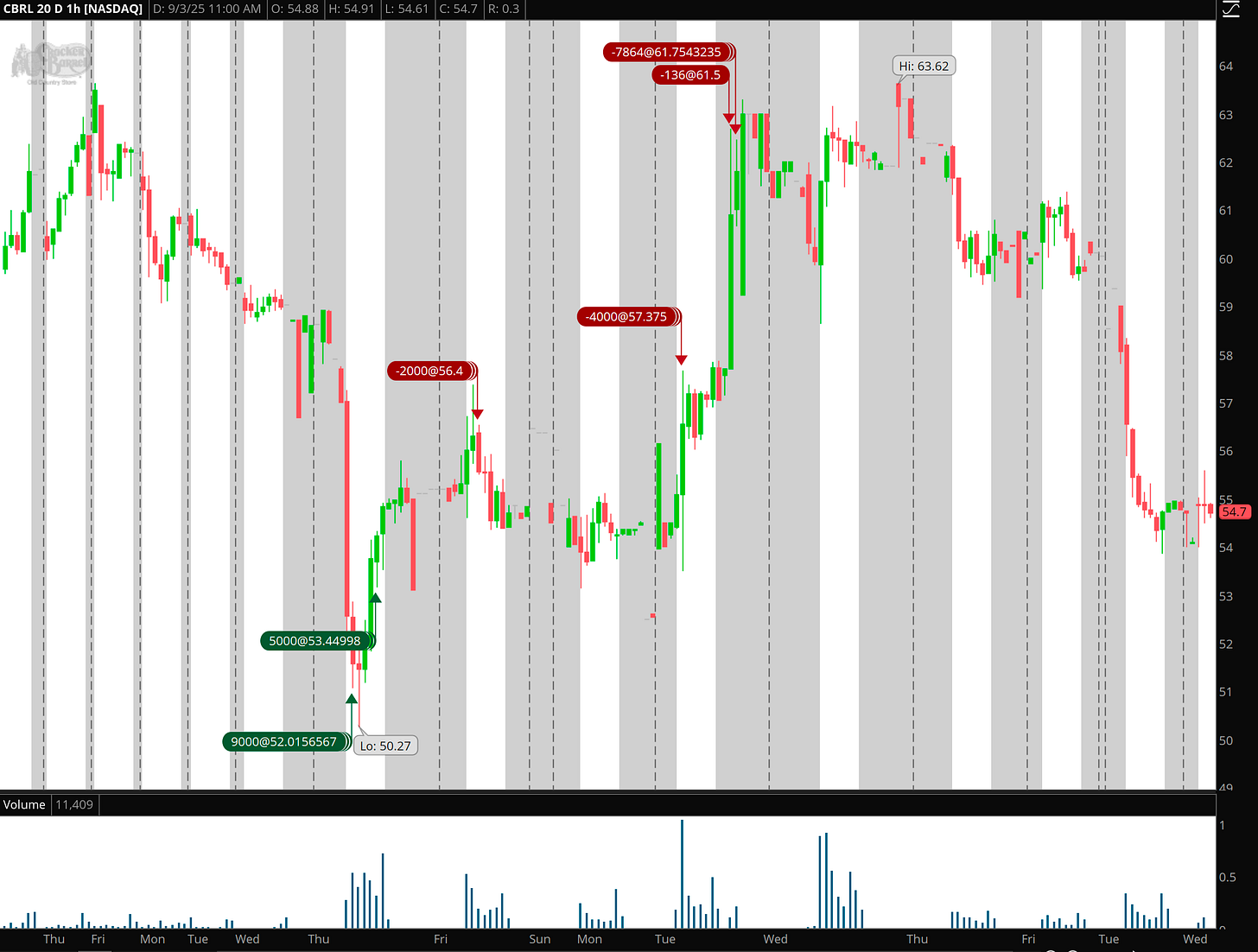

If you truly want to understand how stupid the state of things are, consider the fact that I was able to extract a 6 figure salary out of the market in about 4 days from a plane ride where I was really, really bored.

Our concept of value is so distorted that a few people raging out on Twitter about how a logo can be woke and indicative of a business that’s about to go broke causes such a demand for book depth that you could generate a yearly return basically just by being terminally online. To be clear, this is fucking stupid.

There is a very obvious playbook for trading the Trump administration. The trading week goes from Wednesday to Wednesday — barely anybody on earth has a memory that lasts more than 6 days nowadays — and you figure out what content is going to traverse its way to the “main character” node. (For prior quarters, this has varied between Scott Bessent and Elon Musk, but Trump is the center of the universe and has been for 11 years.) Lo and behold, if you look at how I timed my share sales, it’s simply when a bigger node takes notice and, eventually, forwards it to him.

In some senses it’s exhilarating to get this right over and over (and the monetary reward certainly shouldn’t be scoffed at — I do understand that I have won the hypergambling lotto here), but it’s sheer despair that the world is solvable to this capacity. I don’t care what the economic clergy says, this is not healthy that a business “valuation” can be clanked around 15% by a group of people who have clearly never eaten there regularly. In a sense, this implies that the only markets are private markets.

How do I know that none of these people ate there?

Well, I went to Cracker Barrel.

This is a plate of biscuits and gravy where they forgot my gravy. I took an unfortunate soul along with me, who ordered the pancake platter. What you realize when you go to Cracker Barrel is that it’s an old world singularity business. Much like how Facebook has hit its Total Addressable Market and thus can only find a way to develop an extended brainrot depreciation curve until everyone’s mind turns to mush, Cracker Barrel attempts to do this to the Boomer population with Crisco-ified slop. It’s not even that the food is bad, it’s just nothing. It tastes like nothing other than seed oils and sadness. The product for this business is the leftovers, where getting “one up on Wall Street” is taking home a box while you struggle to digest the first half of the meal you had and insisting on getting the “full value” later. It’s as if you made Dust Bowl desperation a product. And, of course, the tchotchkes on the way out serve as a way to buy your grandkid (not that those exist anymore) some useless crap that “they’d really love” without having to get in your car and drive to another store. It’s the entrapment of convenience where the margins have to work, so it sucks.

Credit to millenials, they really demanded better out of our food culture.

In a way, the terminally online had it right — Cracker Barrel is the perfect example of a decaying institution. There is no way to fix this product. You can’t compress the Northeast idea of Nashville into a kitschy millenial product without destroying its aging, content base. It’s a place that serves its purpose and, once the earnings are extracted and the demographic has passed on, the remaining capital will be returned to shareholders and we’ll probably get a bunch of credit scheme physical popup shops that render the neighborhood unlivable in return. Everything in the US is an exit scam nowadays, and there’s really no way to unsee it.

The main exit scam of the past 25 years has been “everyone goes to college”. The propaganda has built up 18-22 year olds as some sort of sacrosanct, truth telling innocense when they’re mostly idiots. There is no such thing as a 23 year old who has the world figured out — even myself. I look back at how brash I was and, man, it’s very clear why I was unhirable in so many contexts.

It’s not that the economy is worse than 2008 — it’s that the leverage you have to take to play the game is so astronomically high and the social contagion of seeing everyone get rich around you (which is mostly fake) makes it impossible to accept your lot in life and bear it out until your 40s. What most of the people grousing about regarding “tech jobs” don’t understand is that there are no jobs coming back. Just look at the case of Elon and Twitter — you can fire 80% of this business and it still functions as the most pivotal site in the world. If you kill visas, which definitely does need to be done to satiate the pure bloodlust at this point, nothing will happen other than the numbers will go down. Which is necessary, in my view, but will only lead to conflict, as I wrote in my pre-election post:

There’s a palpable sense of desperation everywhere I look, and it’s reflected by the fact that nobody really trusts any institution to properly do anything, whether it’s a court of law or even counting votes. (Look, India counts a billion votes in a day, there is literally no reason a state should supposedly “take a week” to count ballots, though I suspect this won’t actually be an issue.) It is downright embarrassing how much litigation there is around basic, simple, logical things, and it’s a perversion of the legal system that common sense isn’t taken accounted for. The entire purpose of law is that it’s supposed to be subservient to the straightforward meaning when it comes to people! You shouldn’t have to be legally trained to understand most topical issues at the non-federal level. (Of course, this is outright a failure of literacy education and the media, but more at 11.) This desperation is most reflected by the fact that apparently, our answer now is to throw our hands up in the air, toss every single ounce of data that we can legally (and illegally) get access to into a GPU cluster, and pray that the human brain gets solved. It’s so patently ridiculous from my view that every major player is all-in on what I describe as the most expensive, farthest OTM option ever conceived. FFS, the tech gets more expensive as you try and scale it and it isn’t even coherently applicable as a product!

Something has to change immediately, because we are at the point of a debt recursion loop. Look, you can cite whatever numbers you want, I am convinced we are not getting “true” 2% inflation again. Don’t just take it from me, Paul Tudor Jones arrived at pretty much the exact same conclusion.

Inflation, by nature, polarizes wealth. (This is precisely why the fascination with deflationary currencies like Bitcoin came into vogue post-08 — deflation preserves people’s assets.) Here’s a handy way of thinking about inflation.

Let’s say we are to play a game where the loser dies. Would you rather play chess with me, a National Master, for your life, or flip a coin?

The inflation target pretty much does this for businesses. If inflation is too high, only the best-positioned, highest skilled operators can thrive, and the highest-skilled (or luckiest) allocators get rewarded. If inflation is too low, the velocity of money trickles, as why would I flip a coin with you when I could wait for a better game to improve my odds of surviving? Thus, the 2% target is like the variance in a game of Texas Hold’em — just enough to let the skilled players win over time, but not so harsh such that a normal person can’t win sometimes as well.

No matter what, I think the middle class is done for until the paradigm shifts — either (somehow) AGI is achieved within 10 years, there’s a great leap forward in resource collection possibilities (space, energy, rare metals, etc.), or what’s left is a dollar environment that compensates the people without net worths by inflating the denomination of their debt away as infrastructure and purchasing power continues to worsen.

But, here’s the good news — for the first time since 2020, I get the feeling that people are willing to try again. The entirety of 2020 felt like one collective psychotic break that I wasn’t a part of, and the chaos that ensued in 21-22 meant that a lot of people just kept their heads down, and some still are. But for my sect of peers — talented people who didn’t quite get a shot to build anything in the free money era, then immediately got plunged into the pandemic — there’s a palpable urgency that the next few years might be the last shot any of us has to innovate in prime working years, because the environment has been so oppressive to novel thought post-2016.

No matter what, this is not going to end cleanly. The thing about mobs is, you can’t control the mob.

Next post will be on the state of the AI race, and I have a lot more in the pipeline — I just had to break the seal of writer’s block before I started posting again.