Malt Liquidity 34

Stock Wars: Retail Strikes Back

First, a nightcap

A few days ago, Arturo Di Modica, the sculptor of the iconic Wall Street bronze “Charging Bull”, passed away, and I feel like a little air needs to be cleared as a result.

A common frustration for me is the lack of authenticity in the things we are sold. Sometimes the product or the narrative is genuine, and other times there is an ulterior motive involved. Perhaps the most annoying of these frustrations is “native advertising”, where something is masquerading as natural but is pretty clearly sponsored advertising when looked at with even the slightest bit of scrutiny.

The bull sculpture wasn’t that. Fauxlosophers have written plenty of thought-pieces misattributing the symbolic value of the bull to everything from the excesses of capitalism to sexism. Truthfully, it was just a prank - as an act of guerilla art, it showed up in the middle of the night as an expensive joke, of sorts, to cap off a decade that epitomized excess. And it was a good prank! That’s why the bull stuck around!

The shameless attempt to induce symbolic meaning arrived with the “Fearless Girl” statue, sponsored by State Street, a firm which was ironically cited for underpaying women:

The financial services firm behind Wall Street's "Fearless Girl" statue agreed to pay $5 million to settle federal allegations that it paid female executives less than their male counterparts.

The agreement followed a U.S. Department of Labor probe into Boston-based State Street Corporation.

Investigators said their analysis concluded that State Street had paid female executives less in base pay, bonus pay and total compensation than similarly situated males in the same positions.

A made-for-NYT-thoughtpiece bit of marketing eroded away the authenticity of the genuinely bizarre, amusing anecdote of someone dropping a $400k statue in FiDi in the middle of the night, to the point where Bill de Blasio accused Arturo of being sexist for being rightfully annoyed at the original intention of his piece being appropriated for a State Street marketing campaign:

Another salvo has been fired in the battle over Fearless Girl. In the face of criticism of his decision to extend the run of the bronze sculpture of a courageous little girl facing off with the Financial District’s famed Charging Bull, New York City Mayor Bill de Blasio took to Twitter to blast the bull’s sculptor Arturo Di Modica, age 76.

“Men who don’t like women taking up space are exactly why we need the Fearless Girl,” tweeted Mayor Bill de Blasio.

There is a larger point to be made about the co-opting of someone else’s art to shill your own image (bad) vs re-imagining something in your own vision (perfectly fine), but the point of this little diatribe is for me to point out that this was all pretty unfair to Di Modica and to highlight what the sculpture that has provided plenty of fodder for amusement, memorabilia, and jokes was really about:

Having arrived penniless in the United States in 1970, Di Modica felt indebted to the nation for welcoming him and enabling his career as a successful sculptor. Charging Bull was intended to inspire each person who came into contact with it to carry on fighting through the hard times after the 1987 stock market crash…

“My point was to show people that if you want to do something in a moment things are very bad, you can do it. You can do it by yourself. My point was that you must be strong"

Rest in peace, Arturo.

WeWork co-founder and former Chief Executive Adam Neumann is in advanced talks to settle a high-profile legal fight with SoftBank Group Corp. by agreeing to a nearly $500 million cut in his payout from the shared-office-space company’s new owner, a move that would help clear the way for WeWork’s second attempt at a public listing.

According to terms being discussed, SoftBank would spend roughly $1.5 billion to buy the shares of early WeWork investors and employees, including nearly $500 million to purchase shares from Mr. Neumann—in both cases about half of what it originally agreed to, according to people familiar with the talks.

The saga of the human embodiment of vaporware continues as somehow Adam Neumann manages to get 500 million (!!) for essentially worthless stock. Given the control of the company he maintained, though, this payout makes sense - all he had to do was win a game of chicken by convincing SoftBank that he was crazy enough to set his own equity on fire to screw them over before they can SPAC (undoubtedly WeWork is going to find a way to SPAC), and Adam Neumann does not strike me as someone who needs to try hard to convince someone that he’s crazy. I’m glad that other employees get to cash out equity - the collective consciousness was not elevated, but at the end of the day, it’s not a tech company, it’s not a startup, but it is We taking SoftBank’s money.

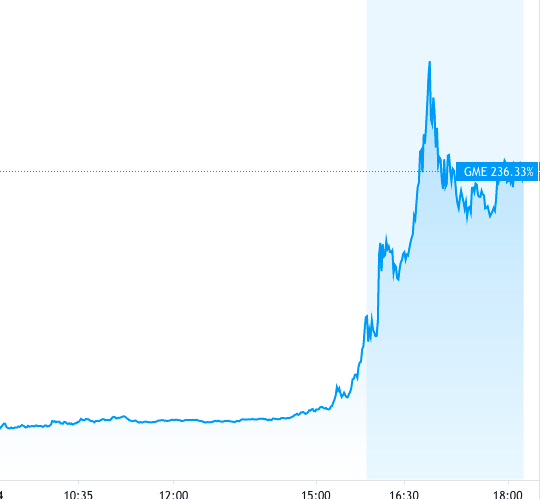

Rocket emoji Ice cream emoji

This post got delayed because apparently memes are back on the menu along with ice cream. For the life of me, I don’t know what happened at the end of the day, but I can guarantee that a bunch of people are going to get margin called or stopped out while shorting from this point on. Retail really did strike back with this one. In hindsight, DFV buying in was probably the long signal, along with this incredibly prescient thread forecasting the return of memes. I don’t know what will happen from here - though I suspect it trades up to around 230 again - but here’s a totally not serious back of the iPad theory:

GME announces a position in Bitcoin. The stock triples, as does Bitcoin.

GME announces they have cashed out their Bitcoin and are starting a SPAC. They name the SPAC GameStocks and reserve the ticker GAMER. The stock doubles.

The S&P Index Committee adds GME as the 10th largest weight in their “passive” index. The stock quadruples.

The GAMER SPAC merges with TSLA (yes, in this scenario, for whatever reason, a public company decides to join a SPAC) to form the most valuable company in the world.

GME’s now-fired CFO still refuses to sell stock

Apologies on the light post, will be back on a tighter schedule after this week.

On that note…

Also, where the hell is Baiju Bhatt in all of this drama?